A Smart Traveler’s Guide to Exchange Money in Vietnam 2024

When traveling to Vietnam, one of the key aspects to consider is handling currency exchange. Understanding how to exchange money in Vietnam effectively can save you from unnecessary fees and help you make the most out of your trip.

In this blog, Prime Travel will provide a comprehensive guide to exchange money in Vietnam, from understanding the local currency to finding the best places to exchange your cash. Whether you’re exchanging money before arriving or while in Vietnam, this guide will ensure you are well-prepared.

Understanding Currency Exchange in Vietnam

Overview

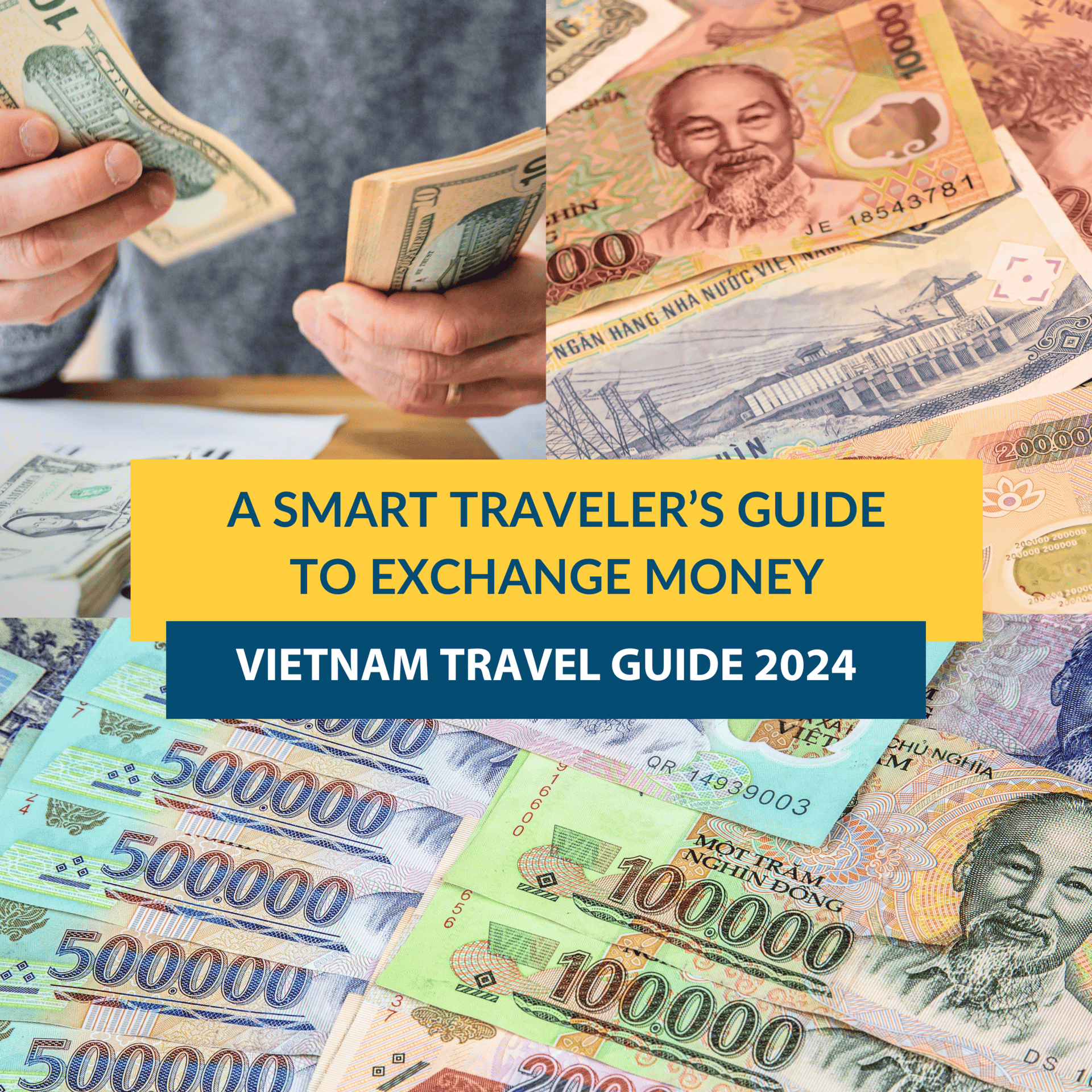

The official currency of Vietnam is the Vietnamese Dong (VND), and it comes in various denominations, making it easy to carry for small and large transactions. Bills are available in 1,000 VND, 2,000 VND, 5,000 VND, and then higher denominations such as 10,000 VND, 20,000 VND, 50,000 VND, 100,000 VND, 200,000 VND, and 500,000 VND.

The currency is made using two different materials depending on the denomination. The lower denominations, under 10,000 VND are made from paper, while the higher denominations starting from 10,000 VND are printed on durable polymer.

Each note is adorned with intricate designs that showcase Vietnam’s rich culture, featuring iconic landmarks, natural scenery, and a portrait of President Ho Chi Minh. The smallest denomination still in use is 1000 VND, while the largest is 500,000 VND. Coins, though previously circulated, are no longer in use today.

Tips:

- The 500,000 VND note, Vietnam’s highest denomination, is a dark green color that can be easily confused with the 20,000 VND bill. While useful for large payments, it may not be accepted for small purchases due to a lack of change. For daily transactions, carrying smaller denominations is recommended.

- It can be overwhelming to see so many zeros on Vietnam currency. There is a locals’ trick, though: Prices are frequently denoted by a “K” to stand for a thousand. For instance, 10,000 dong is equal to 10,000k.

Exchange money in Vietnam: Vietnam Dong – VND (Source: Internet)

Why is it important to exchange money in Vietnam?

While credit cards are accepted in larger hotels, restaurants, and shopping malls, cash remains essential, particularly at local markets, street vendors, and smaller establishments. Be mindful of potential foreign transaction fees, typically 3-4%, when using bank cards abroad. Therefore, it’s advisable to reserve credit card payments for major travel expenses, either on-site or online, such as upscale hotels, premium excursions, flight tickets, and significant purchases like jewelry or designer clothing.

Although some upscale businesses might accept U.S. dollars or euros, this isn’t universally true. Paying in Vietnamese Dong not only ensures wider acceptance but also helps you avoid unfavorable exchange rates often imposed by individual vendors. Exchanging money in Vietnam ensures you’re paying fair prices, avoiding potential losses due to poor conversion rates.

Tips: Please inform your bank of your travel plans to Vietnam to safeguard against potential fraudulent activity.

Read more>>> What About Money in Vietnam

Where to Exchange Money in Vietnam

Banks

One of the most secure ways to exchange money in Vietnam is through banks. There are many banks in Vietnam that offer currency exchange services, with the top four being BIDV, Agribank, Vietcombank, and Vietinbank. Other banks, such as Eximbank, Techcombank, and Sacombank… also provide exchange services.

Each bank has its own distinct exchange rate, which is clear and transparent. Most major banks usually offer good rates, and their reliability is enhanced by providing receipts for every transaction, making it easy to track your exchanges. You can easily find exchange counters in major cities like Hanoi and Ho Chi Minh City by searching on Google Maps for the nearest bank location.

The advantages of exchanging money at banks include a high level of security and minimizing the risk of fraud or receiving counterfeit money. Most banks in Vietnam typically don’t incur any fees, and while the exchange rates are competitive, they may not be the best compared to other options like gold shops or informal exchanges.

However, banks typically operate only during business hours (Monday to Friday, from 8 AM to 4:30 PM), which can be time-consuming. Plus, you may need to provide various documents to prove the reason and purpose of your currency exchange. Long queues can also be expected, especially in popular tourist areas.

Where to exchange money in Vietnam: Techcombank (Source: Internet)

ATM

Another option is to withdraw local currency directly from ATMs. You can withdraw VND by using your credit or debit card, with the amount automatically converted from your card’s currency to VND. The maximum withdrawal per transaction generally ranges from VND 2 million to VND 10 million, depending on the ATM provider and your card issuer’s limits. Some ATMs may allow higher amounts, but withdrawals are often capped by your bank’s daily limit.

The benefit of using ATMs is their availability everywhere, offering easy access at any time 24/7, especially in major cities. Exchange rates are automatically calculated based on the current market rate set by the bank operating the ATM. Carrying just your card means you don’t need to bring large amounts of cash, reducing the risk of theft.

However, in smaller towns or rural areas, ATMs may be less common, so it’s a good idea to carry enough cash if you’re planning to visit tourist spots in these regions. Also, there are usually transaction fees for using foreign cards, typically ranging from 3% – 4% of the withdrawal amount.

And ATMs may charge their own withdrawal fees as well based on the bank (between 20,000 and 50,000 per transaction). High transaction fees and limited withdrawal amounts per transaction can be inconvenient when larger sums are needed. Choose VP bank or TP bank ATM for zero withdrawal fee.

Where to exchange money in Vietnam: ATMs (Source: Internet)

Gold and Jewelry Shops

In Vietnam, gold and jewelry shops often offer money exchange services and provide some of the best exchange rates.

The process is quick, offers favorable rates, and typically has lower fees, making it suitable for those in urgent need of cash who prefer a straightforward experience without extensive procedures.

But, there are risks involved, as not all shops are licensed for currency exchange. Some may operate without proper permits and could potentially scam customers. Although such shops are becoming less common, it’s essential to be cautious to avoid losing money. Exchanging money at these shops remains illegal in Vietnam, so consider this carefully before proceeding.

Where to exchange money in Vietnam: Gold & Jewelry Shop (Source: Internet)

Read more>>> Vietnam Trip Cost from Philippines 2024: Best Reviews for Filipino Travelers

Currency Exchange Counters

Currency exchange counters are available at airports, hotels, and shopping malls, providing a convenient option upon arrival. One advantage of using airport counters is their accessibility; they are easy to find, and staff usually speak English, making the process smoother for tourists. You can also avoid potential risks associated with less regulated exchange environments.

However, the exchange rates at these counters are typically less favorable than those offered by banks or gold and jewelry shops. It’s advisable to exchange only enough money to cover your taxi fare to the hotel, and then seek better rates in the city center.

Where to exchange money in Vietnam: Currency exchange counter at the airport (Source: Internet)

Best Places to Exchange Money in Vietnam

Banks remain the safest and most reliable option for currency exchange in Vietnam. Major banks such as Vietcombank, VP Bank, BIDV, Eximbank, Techcombank, and Vietinbank offer currency exchange services for a wide range of foreign currencies. These banks also handle less common currencies, so for rarer money types, banks are the go-to option.

However, exchanging foreign currency at banks may involve more formalities, and the exchange rates are typically less favorable compared to compared to private exchange services.

Below are some trusted currency exchange locations in major cities that provide competitive rates:

Hanoi

| Name | Address | Type |

| Quoc Trinh Gold Shop | 27 Ha Trung Street, Hang Bong Ward, Hoan Kiem District | Gold & Jewelry Shop |

| 31 Ha Trung Jewelry and Craft Store | 31 Ha Trung Street, Hang Bong Ward, Hoan Kiem District | Gold & Jewelry Shop |

| Nhat Quang Ha Trung Gold Shop | 57 Ha Trung Street, Hang Bong Ward, Hoan Kiem District | Gold & Jewelry Shop |

| Toan Thuy Jewelry and Craft Store | 455 Nguyen Trai Street, Thanh Xuan District | Gold & Jewelry Shop |

| Bao Tin Manh Hai Jewelry and Craft Store | 39 Nguyen Trai Street, Thanh Xuan District | Gold & Jewelry Shop |

Read more>>> Converting USD to VND: A Quick Guide for Travelers 2024

Ho Chi Minh City

| Name | Address | Type |

| Ha Tam Gold Shop | 2 Nguyen An Ninh Street, Ben Thanh Ward, District 1 | Gold & Jewelry Shop |

| Kim Mai Gold Shop | 84C Cong Quynh Street, Pham Ngu Lao Ward, District 1 | Gold & Jewelry Shop |

| Saigon Jewelry Center | 40-42 Phan Boi Chau Street, District 1 | Gold & Jewelry Shop |

| Kim Chau Gold Shop | 784 Dien Bien Phu Street, Ward 10, District 10 | Gold & Jewelry Shop |

| Kim Tam Hai Jewelry Store | 27 Truong Chinh Street, Tan Thoi Nhat Ward, District 12 | Gold & Jewelry Shop |

Practical Tips and Guide to Exchange Money in Vietnam

Bring Crisp, Clean Bills

When exchanging money in Vietnam, it’s important to bring crisp, clean bills. Vietnamese shops and banks generally prefer newer and undamaged currency. Torn or marked foreign notes may be rejected entirely or exchanged at a significantly lower rate.

If you present worn or damaged currency, you may find that some vendors will refuse to accept it, forcing you to seek alternatives. To ensure a smoother exchange process, make an effort to carry bills that are in good condition. Before your trip, check the bills you plan to bring and consider visiting a bank or currency exchange service to obtain fresh notes.

Check Your Money After Exchanging

After exchanging currency, it is essential to count your money and verify its authenticity before leaving the counter. Some regions in Vietnam are known for having issues with counterfeit currency, which can lead to potential losses if you aren’t cautious. Always take a moment to inspect your bills, looking for security features such as watermarks, holograms, or security threads that indicate authenticity.

You can also check polymer banknotes by crumpling them to see if they quickly return to their original shape. Fake banknotes, made of low-quality material, may remain wrinkled and tear easily when crumpled

In case you receive suspicious-looking notes, bring them to the attention of the exchange counter immediately. Taking this simple precaution can save you from headaches and financial loss later on. Remember, being vigilant about your money helps ensure a more secure and enjoyable travel experience.

Guide to exchange money in Vietnam (Source: Internet)

Avoid Large Exchanges at a Time

When exchanging currency in Vietnam, it’s advisable to exchange small amounts rather than large sums. This approach allows you to exchange just enough cash for a few days, reducing the risk of carrying too much at once. While Vietnam is generally a safe country, pickpocketing and theft can still occur, especially in crowded tourist areas. Carrying large amounts of cash can make you a target, so it’s better to keep your cash discreet.

Exchanging smaller amounts also helps you manage your finances more effectively, as it encourages you to plan your spending. If you need more cash, you can easily exchange additional funds as needed, ensuring you remain in control of your budget without risking significant losses due to theft or unexpected expenses.

Read more>>> Tips to travel Vietnam for senior travelers [ Update 2024 ]

Carry Small or Large Denominations

If you’re traveling solo, it’s a good idea to exchange for many small-denomination bills. This makes it easier to handle daily expenses, and street vendors can give you change without any hassle. Larger notes may be difficult for small shops or street vendors to break, and you can avoid issues like price overcharging at street stalls by paying with smaller bills like 20,000 VND; 50,000 VND; 100,000 VND.

If you’ve booked a tour with all expenses covered, such as accommodation and transportation, it’s more convenient to carry larger-denomination bills. This reduces the bulk of cash you need to carry. When necessary, you can break larger bills by making a purchase or exchanging with your local guide for smaller notes. This way, you avoid carrying too much cash while still being prepared for small purchases.

Even if you’re on a package tour, it’s still a good idea to carry a few small bills for tips, quick snacks, or small souvenirs. Being flexible with your cash will ensure a smoother, stress-free travel experience.

Guide to exchange money in Vietnam (Source: Internet)

Be Aware of Exchange Fees and Limits

While exchanging currency in Vietnam, it’s important to be aware of the potential exchange fees and limits that various establishments may impose. Different locations can have varying policies regarding the amounts you can exchange at one time, which can affect your budgeting. Always inquire about any fees or limits before proceeding to ensure that you fully understand the terms of your transaction.

Some international credit and debit cards, such as Capital One (USA), Charles Schwab Bank (USA), and Fidelity Cash Management Account (USA), offer no foreign transaction fees, making them excellent options for travelers.

All three cards are likely accepted at many ATMs in Vietnam, but it’s best to check before using them. Choose ATMs that display the logos of card networks like Visa or MasterCard to ensure you can withdraw money smoothly.

Additionally, many international banks have partnerships with Vietnamese banks. Using cards from banks like HSBC and CitiBank at their partner ATMs in Vietnam may allow you to avoid or reduce withdrawal fees, making your cash access more cost-effective.

Only Exchange at Reputable Locations

To minimize the risk of receiving counterfeit bills, it’s crucial to exchange currency only at reputable banks or well-known gold shops. These establishments typically adhere to strict regulations and quality standards, ensuring that the currency you receive is genuine and reliable.

A small tip is that crowded exchange counters often have a better reputation, as they typically handle more transactions and are under greater scrutiny. Avoid exchanging money at roadside vendors or unknown locations, as these can pose risks of fraud. Moreover, if you have any doubts about a location’s legitimacy, trust your instincts and seek alternatives.

Guide to exchange money in Vietnam (Source: Internet)

Read more>>> Vietnam trip cost: The best budget-friendly from Australia 2024

FAQs on Currency Exchange in Vietnam

Is It Better to Exchange Money Before Arriving in Vietnam?

If possible, exchange some money before traveling to Vietnam to ensure a worry-free trip without concerns about finding currency exchange options upon arrival. However, if it’s difficult to obtain VND in your home country, you can exchange money once in Vietnam.

In many countries, the exchange rate for converting foreign currency to VND may not be favorable, especially if it’s not a widely traded currency. Therefore, you’ll likely get a better rate if you exchange money in Vietnam.

How Can I Avoid High Transaction Fees When Withdrawing from ATMs?

To avoid high ATM fees, try withdrawing larger amounts at once (within the limit) to reduce the number of transactions. Additionally, some international banks have partnerships with Vietnamese banks that allow for fee-free withdrawals, so it’s worth checking with your bank beforehand.

Can I Use US Dollars or Euros Directly in Vietnam?

In some tourist-heavy areas, US dollars or euros may be accepted. However, this is not the norm, and you will generally get a poor exchange rate when paying in foreign currency. It’s always best to exchange money and pay in VND for the most favorable rates.

Is Tipping Common in Vietnam and How Much Should I Tip?

Tipping in Vietnam is not mandatory but is appreciated for good service. A common practice is to tip around 10% of the bill in restaurants. For taxi drivers, rounding up the fare is a nice gesture, and for hotel staff, small tips for bellhops or housekeeping are also appreciated.

Conclusion

Exchanging money in Vietnam doesn’t have to be a complicated process. Whether you choose to exchange money at banks, ATMs, or gold shops, following this guide ensures you will find the best options available. With some careful planning and by following the practical tips mentioned, you can make the most of your cash while traveling through Vietnam.

Read more>>>